Business Insurance in and around Seattle

One of the top small business insurance companies in Seattle, and beyond.

Helping insure small businesses since 1935

Insure The Business You've Built.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Jeffrey Taylor help you learn about great business insurance.

One of the top small business insurance companies in Seattle, and beyond.

Helping insure small businesses since 1935

Get Down To Business With State Farm

Whether you are a psychologist a drywall installer, or you own a bicycle shop, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Jeffrey Taylor can help you discover coverage that's right for you and your business. Your business policy can cover things such as computers and business liability.

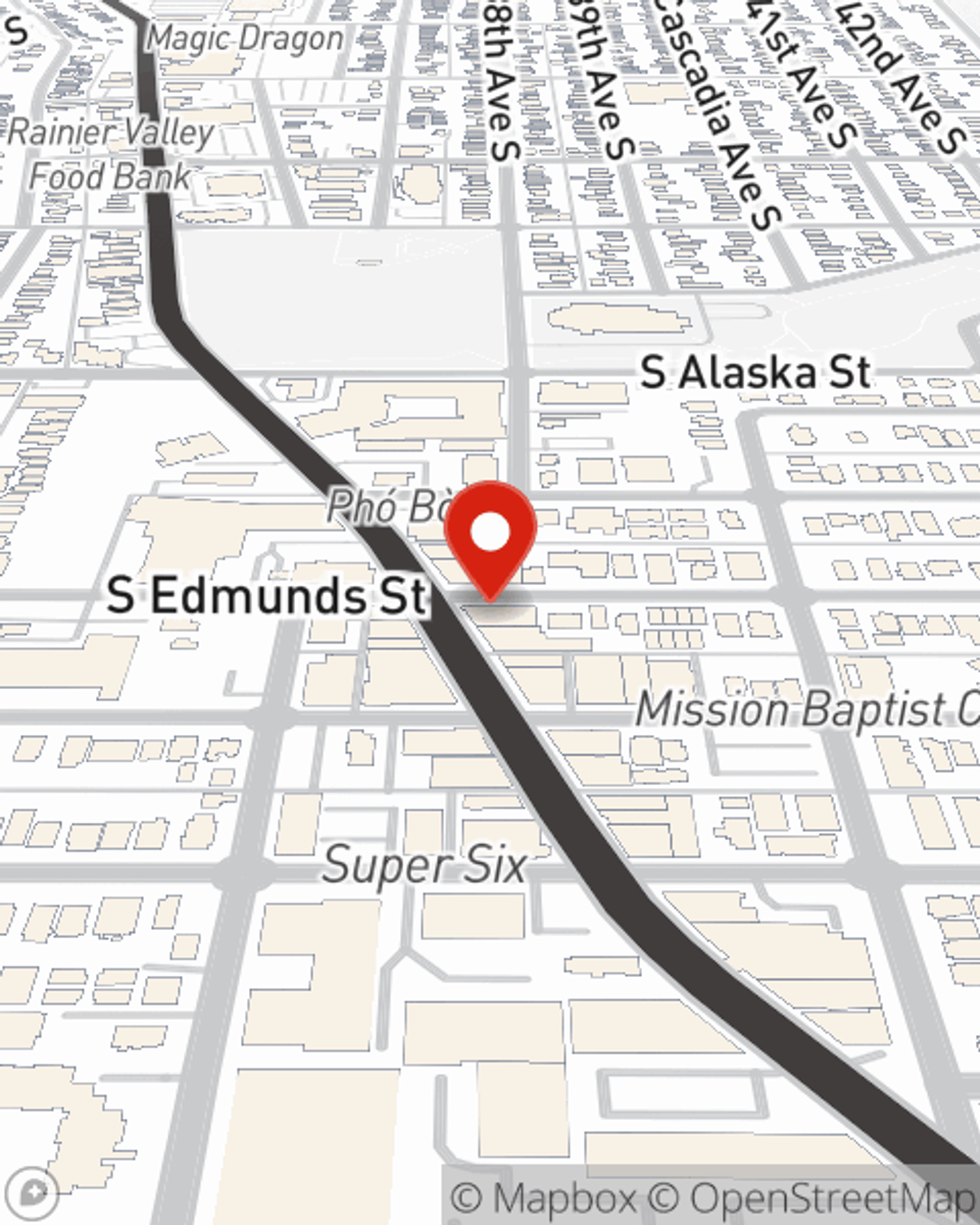

Reach out to State Farm agent Jeffrey Taylor today to find out how one of the leaders in small business insurance can ease your business worries here in Seattle, WA.

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Jeffrey Taylor

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.